Content

Fixed costs on the balance sheet may be either short- or long-term liabilities. Finally, any cash paid for the expenses of fixed costs is shown on the cash flow statement. In general, the opportunity to lower fixed costs can benefit a company’s bottom line by reducing expenses and increasing profit. Identifying Fixed Expenses Fixed cost refers to the cost of a business expense that doesn’t change even with an increase or decrease in the number of goods and services produced or sold. Fixed costs are commonly related to recurring expenses not directly related to production, such as rent, interest payments, and insurance.

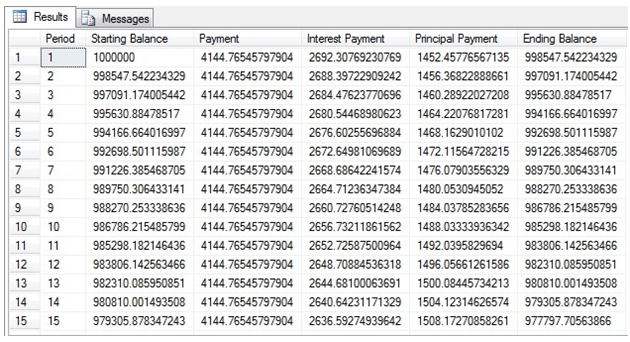

If you understand fixed, variable, and total costs, you can perform more valuable business analysis. The warehouse and forklift costs remain unchanged regardless of how many products they sell, giving them a total fixed cost of $5,000 + ($800 x 2), or $6,600. By dividing its TFC by 50 — the number of units the business produced last month — the company can see its average fixed cost per unit of product. Since fixed costs are not related to a company’s production of any goods or services, they are generally indirect. These costs are among two different types of business expenses—the other being variable costs—that together result in their total costs. It is generally advisable for small businesses that want to remain profitable at all times to have a lower proportion of fixed costs.

Variable Cost vs. Fixed Cost: What’s the Difference?

For example, you might spend more on electricity in July than you do in December because of air conditioning. If a budget was only about our fixed expenses, we wouldn’t have to do too much, would we? But unless you’re one of the most disciplined people in the world with a routine that doesn’t change, you will have other costs pop up. Food is actually one of the biggest variable expenses—and there are plenty of opportunities to save on it.

Fixed costs are not linked to production output, so these costs neither increase nor decrease at different production volumes. Fixed costs are output-independent, and the dollar amount incurred remains around a certain level regardless of changes in production volume. Thus the average fixed cost for the company is $8.50 per unit produced. While fixed costs do not continually fluctuate, it does not mean that fixed costs always remain the same. There are two kinds of fixed costs, short-term and long-term; a business must be aware of each one.

Examples of fixed costs

Lowering your fixed costs creates automatic, non-optional saving. Not only will you be able to free up money to pay down debt or save for your future, you may not have to give up as much of your lifestyle. Unlike fixed expenses, you can control your variable expenses to leave room for https://online-accounting.net/ profits. These costs are often time-related, such as the monthly salaries or the rent. When you’re steering your business through an economic crisis, you can look to variable costs to guard against cash flow problems. As output increases, per-unit variable costs usually decrease.